Insurance for autism: Everything parents should know

Updated: January 28, 2024 · 7 Minute Read

Reviewed by:

Max Meyerhoff, Health Insurance Expert

Highlights

- Before you even start looking at plans, it’s important for you to think about what your family needs the most like therapies, medications, and other services.

- Generally, if you and your family have recurring high medical expenses, it is a good idea to pay a higher premium for a lower deductible so that your healthcare insurance plan starts covering more services sooner. (We'll cover what all this means below!)

- There are healthcare plans for people who are more picky about their doctors, families who want a variety of options, and those who live in the city or rural areas.

Insurance for autism is a topic we've had many parents ask us about. When you have a child on the autism spectrum, the lifetime cost can be as high as $1.4 to $2.4 million.1 A large portion of that increase will come in the form of medical bills, so finding the right health insurance for you and your family is very important.

Whether you’re getting your insurance by purchasing directly from an insurance company, from the Health Insurance Marketplace, or through your employer at work, let’s find the best health insurance plan for your family so that you can decrease those medical bills and save some money!

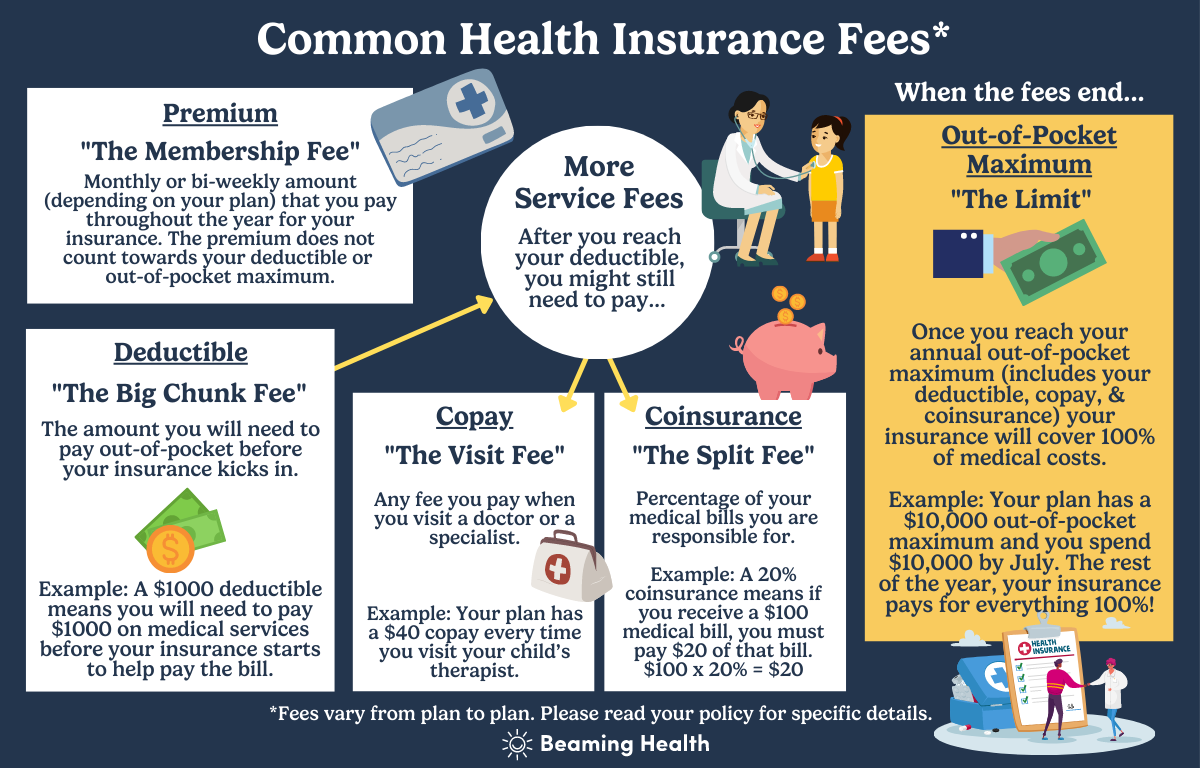

First, here are some important insurance terms to remember:

Reading an insurance plan description can be confusing. As you search for your ideal insurance plan, you might need a refresher on some terms:

Premium: This is the amount you pay for health insurance on each paycheck (employer-backed healthcare plans) or the monthly fee you pay to an insurance company (marketplace healthcare plans).

Deductible: This is usually the big sum of money you need to pay first out-of-pocket before your insurance kicks in. For example, if there’s a $1,000 deductible, you have to pay $1,000 before your health insurance starts covering services. It’s important to remember that usually there is both an individual deductible for each person on the plan and a collective family deductible. If most of your family has low expected medical costs, but you have a child with special needs with high expected medical costs, pay attention to the individual deductible number since that is the threshold you will first hit. It’s also important to remember that your deductible usually resets every year in January.

Copay: There is sometimes a flat fee you may need to pay for common medical services, such as a doctor’s appointment. For example, there might be a $40 copay every time you visit your child’s therapist. A copay is seperate from a deductible and would only apply to certain common services. Many plans that have a high deductible do not offer a copay for any services so check your plan if there are any procedures that only require you pay a copay.

Coinsurance: One more fee to remember. Once you reach your deductible, you still might need to pay a percentage of your medical bills. For example, if your plan has a 20% coinsurance and a procedure costs $100, you will still need to pay $20 of that bill after insurance pays for 80% of the cost ($100 x 20% = $20).

Out-of-pocket costs: All the costs, not counting your plan's premium, that you must pay. This includes copays, coinsurance, and deductibles.

Out-of-pocket maximum: There are a lot of fees to remember but there is some good news. There is a maximum you will pay out-of-pocket for covered healthcare. If your out-of-pocket maximum is $10,000, for example, once you’ve spent that amount, your insurance pays for everything 100% until the end of the year.

What is covered by health insurance?

Before you even start looking at plans, it’s important for you to think about what matters most to you. You want to make sure you are selecting a plan that covers the things you need the most. Some things you may want to think about include:

Services like ABA or speech therapy. Children with autism tend to spend a lot more hours in therapy learning communication and social skills than their neurotypical children. If your child needs any sort of therapy such as ABA, speech, OT, PT, or any other specialty services like medical evaluations, you’ll want to look for plans that include coverage for those services. Some plans cover a limited number of sessions a year without a medical autism diagnosis while others might cover an unlimited amount if your child has a diagnosis. All plans are different, so be sure to ask! If you're looking for new services, you can use our directory to find neurodiversity-friendly providers who are covered by your insurance.

Prescription medication. Are there any medications anyone in your family takes on a regular basis? If you or your child need specific medications, make sure to look for plans that include prescription coverage.

Annual and regular checkups and visits. If you are seeing a doctor or specialist regularly, it may make sense to opt for a plan with a higher premium in exchange for a lower copay. If you have a specific specialist you want to start seeing, you’ll want to make sure they are in your network. Even if you don’t have a specific provider in mind, you’ll still want to consider a plan’s network size and the location of providers.

What types of health insurance plans are available?

Different plans have different rates and can impact the doctors and specialists your family can see. The most common types of plans include:

HMO, the in-network only plan. An HMO (Health Maintenance Organization) plan can only be used with providers who are in-network, aka they have a contract with your health insurance company. Monthly premiums tend to be lower, but you usually need to get a referral from your primary care physician (PCP) to see a specialist. HMOs are good for families that are flexible and don’t necessarily have a favorite doctor or specialist they want to see. If you do have a favorite doctor or specialist, make sure they are an in-network provider on the plan you chose or your insurance won’t cover them.

PPO, the covers everything plan. A PPO (Preferred Provider Organization) plan usually has a higher premium than an HMO but will cover care with both in and out-of-network providers. This means you have more options and won’t need to get a referral from your PCP to see a specialist!

EPO, the more flexible HMO plan. The EPO (Exclusive Provider Organization) plan only covers in-network providers unless there is an emergency. You do not need to get a referral from your PCP to see a specialist. Premiums are usually higher than HMOs but lower than PPOs.

POS, the more affordable PPO plan. POS (Point of Service) plans have a slightly lower premium than PPOs, and you can see both in and out-of-network providers. You will need to get a referral from your PCP to see a specialist.

Which healthcare plan do I choose?

This is a lot of information to digest and a lot to think about. You may be asking yourself, “but what insurance plan is right for me and my family?” While everybody is different and will have specific needs that influence which type of plan they should choose, here are some common scenarios you may want to consider:

If you’re flexible with who you work with, you should consider an HMO or an EPO. These plans don’t cover out-of-network doctors, so you will be limited to who you can see, but they normally have lower monthly premiums.

If you want a lot of options, you should consider a PPO or POS plan. Because they cover out-of-network providers, both PPO and POS plans give you a much wider range of options for both doctors, therapists, and specialists.

If you live in a rural area, you should probably consider a PPO plan. Your local options may be limited if you don’t live in the city. With a PPO plan, you won’t need to worry about potentially needing to use an out-of-network provider.

If you just want to save money, there is unfortunately no universal choice. You may be tempted to choose a plan with the lowest monthly premium, but high deductibles and other fees may force you to spend a lot more out of pocket in the long run. To find the most cost-effective plan for your family you’ll need to compare your top plan options and do some math. Not a math person? Don’t worry, keep reading and we will help with that!

How do I find the most affordable plan?

Once you have narrowed down your options, assuming that the benefits of the plans are similar, you’ll want to compare costs.

.png)

For example, let’s say that both plans are covered at 80% after the deductible. Plan A has a $50 per two-week premium with a $1,000 deductible and plan B has a $20 per two-week premium with a $3,000 deductible. Plan A will cost ($50 x 26 weeks) $1,300 for the year plus the $1,000 deductible. Plan B will cost ($20 x 26) $520 for the year plus the $3,000 deductible. If you spend over $3,000 in health expenses in the year, plan A will cost $2,300 and plan B will cost $3,520. Even though you spend more every month on your premium for Plan A, it will save you more money than Plan B!

When can I sign up for health insurance? When can I change my health insurance plan?

Unfortunately, when it comes to signing up for a health insurance plan or making changes to a current plan, you can only do so under certain circumstances and during specific times of the year.

When starting a new job. When it comes to employer-backed insurance plans, you’ll have the option to select a new health insurance plan upon hire or after a set probation period, depending on your employer.

During a Special Enrollment Period. If you had an employer-backed insurance plan, but are no longer with the employer for any reason and lost your coverage, don’t worry, you can purchase an insurance plan through the Health Insurance Marketplace during a Special Enrollment Period. A Special Enrollment Period lasts for 60 days after a major life change.2 Major life changes include changes in your household (like getting married or having a baby), change in residence, and loss of insurance (like when you lose or change jobs).2

During Open Enrollment. Annually, for both employer-backed and Marketplace plans, you can enroll in a new health insurance plan or change your current plan during open enrollment. Open enrollment normally takes place in October or November.

Conclusion

Finding the right health insurance plan for you and your family can be hard, but with a little patience and preparation, you can find the right plan to fit your family’s unique needs.

Once you’ve narrowed down your plans you can do the same kind of cost comparison, as demonstrated, for your plan options. Generally, if you and your family have recurring high medical expenses, it is a good idea to pay a higher premium for a lower deductible so that your healthcare insurance plan starts covering more services sooner. It’s also typically more affordable to visit in-network healthcare providers.

Get our best articles delivered to your inbox each month.

We respect your privacy.

Dive Deeper

Article References

- Horvath, H. How to afford raising a child with disabilities. Policygenius. December 20, 2021. Accessed June 9, 2022. https://www.policygenius.com/disability-insurance/news/financial-planning-child-disability/#:~:text=It%20costs%20an%20estimated%20%24233%2C610,is%20%241.4%20to%20%242.4%20million.

- Getting health coverage outside Open Enrollment. HealthCare.gov. Accessed June 15, 2022. https://www.healthcare.gov/coverage-outside-open-enrollment/special-enrollment-period/

- Daly R, writer/editor H senior. Enrollment of large-company workers in high-deductible plans reaches a historic high. hfma. Accessed June 28, 2022. https://www.hfma.org/topics/news/2019/08/enrollment-of-large-company-workers-in-high-deductible-plans-rea.html